what is an open end equity lease

The open-end TRAC lease has been a staple in the fleet industry for decades. The lease contract spells out the framework of the deal at the end of the lease including the projected value of the car.

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

An open-end lease with a TRAC allows a rental adjustment against the vehicles outstanding book value at the end of the lease.

. This type of leasing is more often used for commercial purposes because the open-end lease gives unlimited mileages. He will pay the bill if the depreciation is worse than expected. On January 1 2017 XYZ Company signed an 8-year lease agreement for equipment.

The lender is responsible for any. In most open-end leases you are also entitled to any refund if the actual. Open-end TRAC leases enable fleet.

However it is possible in some cases and we can explain how this can happen. The outstanding balance will decrease and the vehicle will continue to depreciate. Open End 36 months.

In an open-end lease subject to the three-payment rule you are responsible for any difference if the actual value of the vehicle at scheduled termination is less than the residual value stated in your lease deficiency see glossary entry Open-end lease for a definition of the three-payment rule. A lease contract for a car allows you to drive the car make payments for a certain number of months and then turn the car back in to the leasing company. It is hard to say if the positive equity will increase after the extra time provided to you.

It may also be referred to as a capital lease operating lease or TRAC lease With this type of lease your business has the option to retain equity in the vehicle while freeing up capital. Understanding Lease Equity. Pass the journal entries in books.

For example if a companys machinery has a 5-year life and is only valued 5000 at the end of that time the salvage value is 5000. The lease terms in a. Open-end leases are pervasive in fleet leasing because they offer fleet managers greater control of asset utilization and disposal.

Lease equity is when your car is worth more at the end of the lease than the buyout that was established when the lease began. At the end of the lease the equipment will revert to the lessor. Open- and closed-end leases.

In a closed-end lease the lessor assumes the depreciation risk but the terms are more restrictive. However your insurance company does not consider the total value you owe to your bank. Lets walk through a lease accounting example.

The employer takes all the financial risk. This happens when the lessee drives less than the mileage allotted. A companyemployer will assume management and leasing of the car to its employees not the leasing company.

Vehicle used 36 months60000 miles. An open-end lease combines the flexibility of ownership with the potential cash flow and tax advantages of leasing. A closed-end lease is a rental agreement that puts no obligation on the lessee to purchase the leased asset at the end of the agreement.

The comprehensive portion of your policy pays your leasing bank for your vehicles market value if it is stolen. This works well for employers since the cost of the vehicles can be written-off or expensed. Read more at the end of useful life is nil.

When you lease a car you dont own it unless you buy it at the end of the term. We just have to think of transport and courier companies they prefer to amortize the real cost of depreciation instead of paying. In an open-end lease the lessee agrees to a minimum term thats.

Lets take a closer look at the two most common options available to commercial fleets. An open-end lease is one in which the lessee a business to be clear these arent available to the general public agrees to accept the financial risk. Annual payments are 28500 to be made at the beginning of each year.

Ford Taurus with standard fleet equipment. TRAC is an acronym for terminal rental adjustment clause However the basic principles of the TRAC lease sometimes are misunderstood. Open End One-month LIBOR 50 percent.

An open-end lease is a bigger gamble for the lessee who is accepting more of the risk. During the term of your lease contract you are required to maintain collision coverage on your car which also includes comprehensive coverage. Start by inputting your desired vehicles purchase price your down payment in cash and your trade-in allowance if applicable.

This tool approximates costs associated with leasing a vehicle. You can return the vehicle and either receive a credit or a bill for the difference between what you owe and how much the vehicle is sold for. The open-end lease puts all the financial risks on the lessee.

Very simply in an open-end lease the lessee assumes the depreciation risk but has more flexible terms. We asked lessors at three fleet leasing and management companies to dig a little deeper into both to help you determine the lease that works. However in an open-end lease you would be able to receive a check from the owner for the difference.

CLOSED END LEASE COST COMPARISON. With The Equity Group you can expect the best. Open-end leases also exist and are most often used in the case of commercial business lending.

Open End 20 percent per month. Re-leasing the vehicle will extend the payments for a few months. Open-end leases carry a shorter term and usually last a minimum of one year but this type of lease can be extended on a month-to-month basis.

Closed End 18 percent per month. What is an open-end lease. Finish up by entering the sales tax percentage the lease term in months the lending rate APR and the cars projected value at the end of the.

The dealer will refer to this value as the residual value. A basic tenet of accounting is matching expense to the time period in which it occurs. Open-end lease contracts are more compatible with businesses that have less predictable but greater mileage requirements than the average 12000 miles-per-year of a non-business lease.

The monthly lease payment at the end of each month is 200. Closed End Prime 10 percent. The lease term was for 6 years and the interest rate stood 12.

Because a leased vehicles actual cash value doesnt equal the residual value until the end of a lease term having a leased car with equity is quite rare.

Open Vs Closed End Leases What To Know Credit Karma

Should You Choose An Open End Or A Closed End Car Lease Credit Finance

What Is The Difference Between An Open Vs Closed Lease

Lease Accounting Calculations And Changes Netsuite

Real Estate Private Equity Career Guide

What Is The Difference Between An Open Vs Closed Lease

Should You Lease Or Buy Your Fleet Vehicles Fleetio

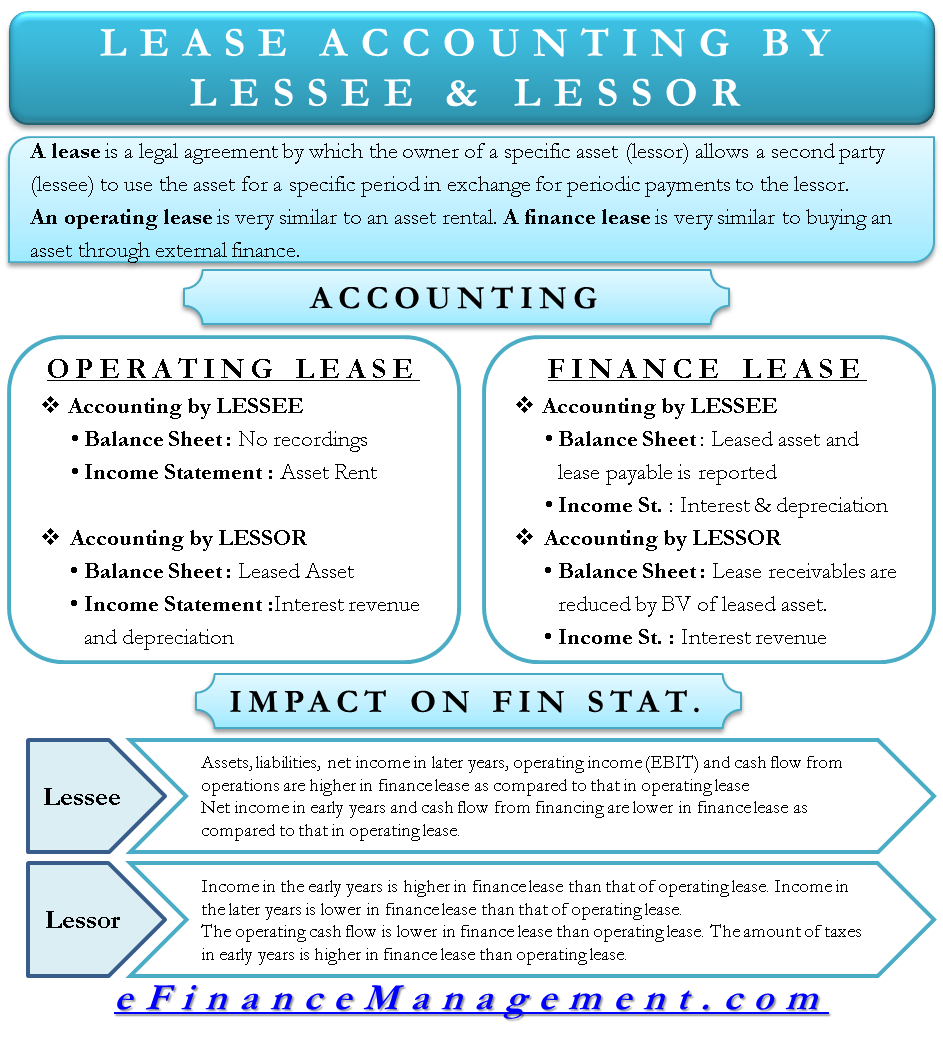

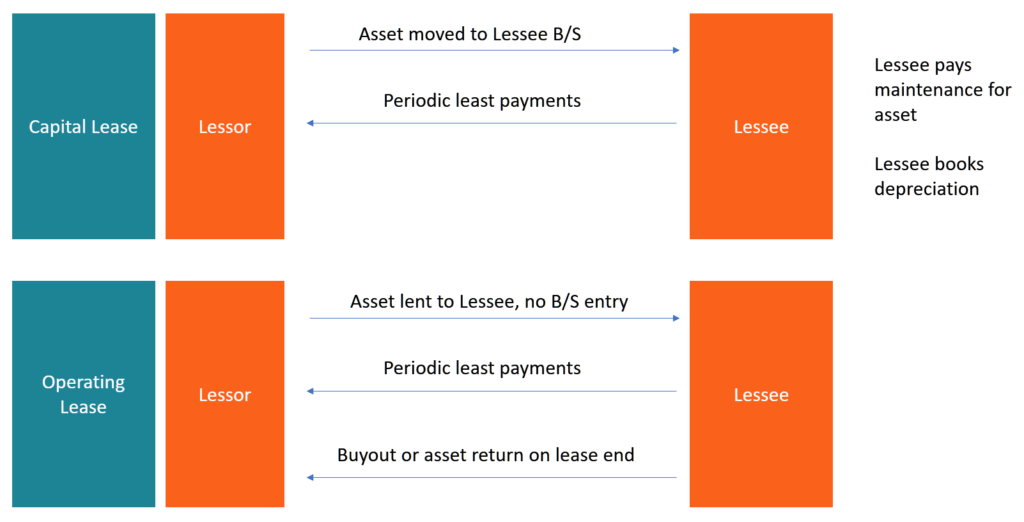

Lease Accounting Treatment By Lessee Lessor Books Ifrs Us Gaap

What Is The Difference Between An Open Vs Closed Lease

If You Lease Here S How To Leverage Lofty Trade In Values Into A Profit

Operating Lease Learn How To Account For Operating Leases

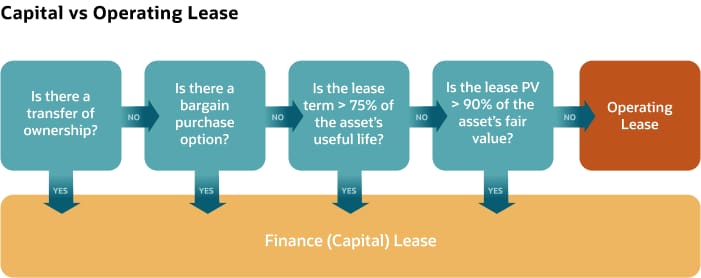

Capital Lease Vs Operating Lease What You Need To Know

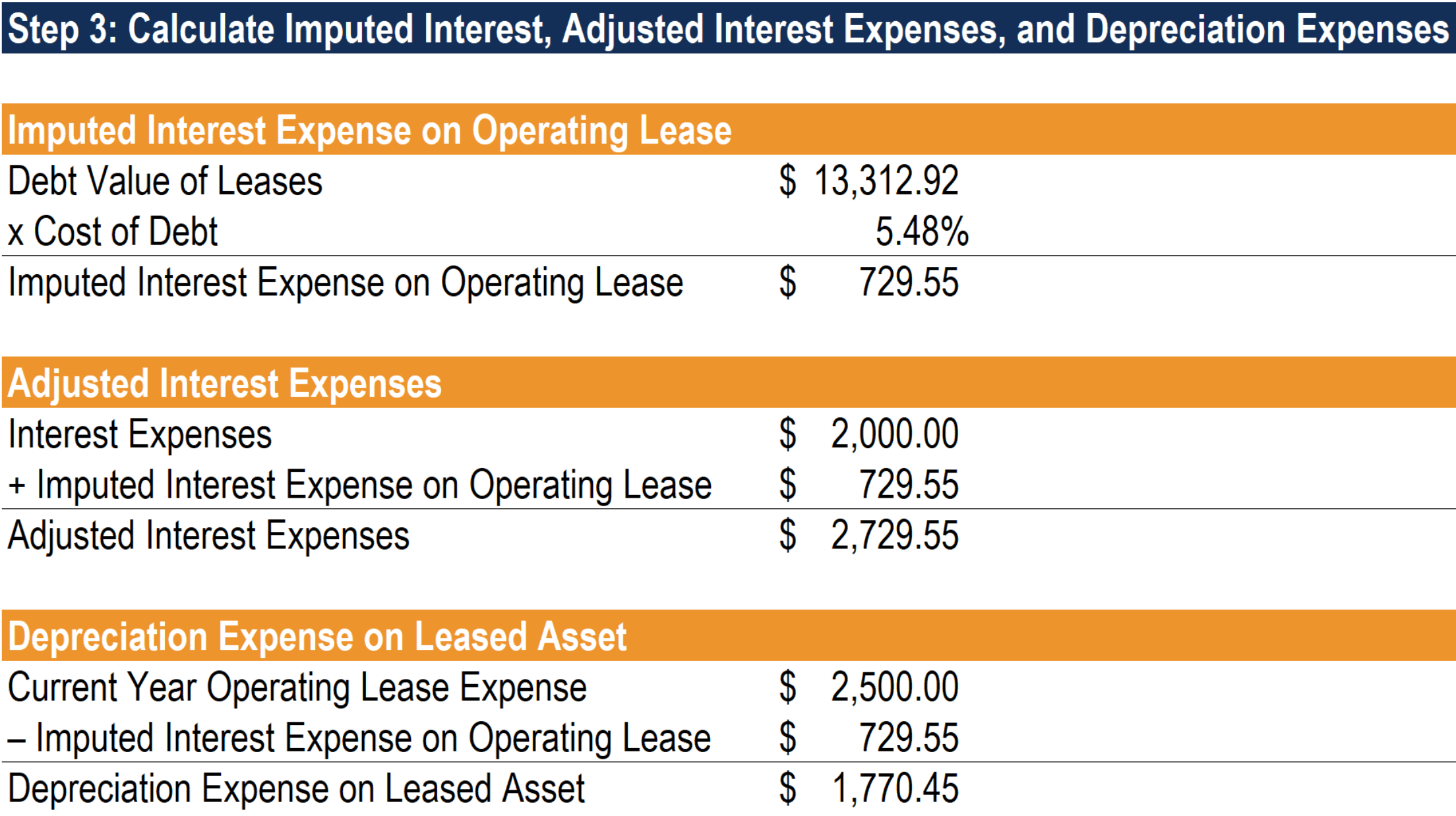

Lease Accounting Operating Vs Financing Leases Examples

:max_bytes(150000):strip_icc()/GettyImages-912785590-bd21254b8f914ad1a28876e45800554c.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1149107425-99d2c7fcb6264e13bb34f7746eeabb0d.jpg)

:max_bytes(150000):strip_icc()/Short-Term_Car_Lease_GettyImages-1152293815-559b180c09644bb2985f5516d2a6a101.jpg)